Triple Nets (NNN) Tic's (Tenant in Common Onwership) are they too good to be true?

By Ron Benning, Broker/Owner 1st Priority Realty

Sacramentoinvestor.com, (916) 730-3846

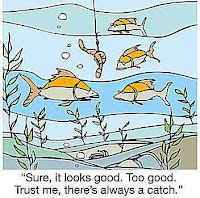

Recently everywhere I look I see online advertisements for seemingly miraculous real estate investments that are supposed to take all the work out of owning real estate and they often also imply most of the risk too.

A few years back there were many groups coming through town offering free steak diners to my clients to come in and hear about the sure fire investment opportunities. Many of them even said bring your real estate agent! At that time I went to one of these dinners with a client of mine. I remember leaving that dinner thinking how can I compete with the type of returns and flexibility of this type of investment?

They said to invite your agent because this type of investment requires a securities license so they knew most agents couldn't sell this type of investment anyway.

Let me start by saying there are probably many legitimate investment opportunities that are being marketed this way, but in all honesty I have at least 3 clients that lost their entire investment on one of these sure thing investments.

I am reminded of a quote in one of the best books on money I ever read from George S. Glason "The Richest Man in Babylon" .

"Gold flees the man who would force it to impossible earnings or who follows the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment".

Again I am not saying all of these are bad, but you must ask yourself a few basic questions to begin with to better see if the investment passes the Smell Test.

1) If they are offering a return that is well above the normal Cap Rate for traditional real estate investments on the market why are they offering a higher rate?

2) Is the investment Securities backed? These can often have much greater risk.

3) If you are buying an investment based on a one tenant lease what happens if you lose the tenant?

No, I don't offer any get rich quick real estate investments because most wealthy real estate investors I know built there wealth one property at a time. This is a simple plan most people can follow if they just have a little discipline and patience.